Hammer and Hanging Man

The hammer and hanging man look exactly alike but have totally different meanings depending on past price action. Both have cute little bodies (black or white), long lower shadows, and short or absent upper shadows.

Just because you see a hammer form in a downtrend doesn’t mean you automatically place a buy order! More bullish confirmation is needed before it’s safe to pull the trigger.

A typical example of confirmation would be to wait for a white candlestick to close above the open to the right side of the hammer.

Recognition Criteria:

- The long shadow is about two or three times of the real body.

- Little or no upper shadow.

- The real body is at the upper end of the trading range.

- The color of the real body is not important.

The long lower shadow shows that sellers pushed prices lower during the session. Buyers were able to push the price back up some but only near the open.

This should set off alarms since this tells us that there are no buyers left to provide the necessary momentum to keep raising the price.

Recognition Criteria:

- A long lower shadow which is about two or three times of the real body.

- Little or no upper shadow.

- The real body is at the upper end of the trading range.

- The color of the body is not important, though a black body is more bearish than a white body.

Inverted Hammer and Shooting Star

The inverted hammer and shooting star also look identical. The only difference between them is whether you’re in a downtrend or uptrend. Both candlesticks have petite little bodies (filled or hollow), long upper shadows, and small or absent lower shadows.

Fortunately, the buyers had eaten enough of their Wheaties for breakfast and still managed to close the session near the open.

Since the sellers weren’t able to close the price any lower, this is a good indication that everybody who wants to sell has already sold. And if there are no more sellers, who is left? Buyers.

The shooting star is a bearish reversal pattern that looks identical to the inverted hammer but occurs when price has been rising. Its shape indicates that the price opened at its low, rallied, but pulled back to the bottom.

This means that buyers attempted to push the price up, but sellers came in and overpowered them. This is a definite bearish sign since there are no more buyers left because they’ve all been murdered.

Spinning

Tops

Japanese candlesticks with a long

upper shadow, long lower shadow and small real bodies are called spinning tops.

The color of the real body is not very important.

The pattern indicates the indecision

between the buyers and sellers.

The pattern indicates the indecision between the buyers and sellers.

The small real body (whether hollow

or filled) shows little movement from open to close, and the shadows indicate

that both buyers and sellers were fighting but nobody could gain the upper

hand.

Even though the session opened and

closed with little change, prices moved significantly higher and lower in the

meantime. Neither buyers nor sellers could gain the upper hand, and the result

was a standoff.

If a spinning top forms during an

uptrend, this usually means there aren’t many buyers left and a possible

reversal in direction could occur.

If a spinning top forms during a

downtrend, this usually means there aren’t many sellers left and a possible

reversal in direction could occur.

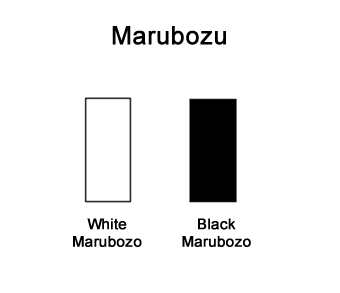

Marubozu

Sounds like some kind of voodoo

magic, hoo? “I will cast the evil spell of the Marubozu on you!” Fortunately,

that’s not what it means. Marubozu means there are no shadows from the bodies.

Depending on whether the candlestick’s body is filled or hollow, the high and

low are the same as its open or close.

A White Marubozu contains a

long white body with no shadows. The open price equals the low price and

the close price equals the high price. This is a very bullish candle as

it shows that buyers were in control the entire session. It usually becomes the

first part of a bullish continuation or a bullish reversal pattern.

A Black Marubozu contains a

long black body with no shadows. The open equals the high and the close

equals the low. This is a very bearish candle as it shows that sellers

controlled the price action the entire session. It usually implies bearish

continuation or bearish reversal.

Doji

Doji candlesticks have the same open and close price or at least their

bodies are extremely short. A doji should have a very small body that appears

as a thin line.

Doji candles suggest indecision or a

struggle for turf positioning between buyers and sellers. Prices move above and

below the open price during the session, but close at or very near the open

price.

Neither buyers nor sellers were able

to gain control and the result was essentially a draw.

There are four special types of Doji

candlesticks. The length of the upper and lower shadows can vary and the

resulting forex candlestick looks like a cross, inverted cross or plus sign.

The word “Doji” refers to both the singular and plural form.

When a Doji forms on your chart, pay

special attention to the preceding candlesticks.

If a Doji forms after a series of

candlesticks with long hollow bodies (like White Marubozus), the Doji signals

that the buyers are becoming exhausted and weakening. In order for price to continue

rising, more buyers are needed but there aren’t anymore! Sellers are licking

their chops and are looking to come in and drive the price back down.

If a Doji forms after a series of

candlesticks with long filled bodies (like Black Marubozus), the Doji signals

that sellers are becoming exhausted and weak. In order for price to continue

falling, more sellers are needed but sellers are all tapped out! Buyers are

foaming in the mouth for a chance to get in cheap.

In the next following sections, we

will take a look at specific Japanese candlestick pattern and what they

are telling us. Hopefully, by the end of this lesson on candlesticks, you

will know how to recognize different types of forex candlestick patterns

and make sound trading decisions based on them.

Introduction to Japanese candlestick chart is incomplete without talk about of dissimilar terminologies implicated. For more

ReplyDeleteSee here.

Hello Everybody,

ReplyDeleteI've attached a list of the highest ranking forex brokers:

1. Most Recommended Forex Broker

2. eToro - $50 min. deposit.

Here is a list of the best forex tools:

1. ForexTrendy - Recommended Probability Software.

2. EA Builder - Custom Strategies Autotrading.

3. Fast FX Profit - Secret Forex Strategy.

I hope you find these lists helpful.